VAT is a standard part of your business energy bill—but are you paying more than you should be?

Many UK businesses don’t realise they could be eligible for reduced VAT rates on their electricity and gas. And with energy costs already high, understanding how VAT is applied is crucial for controlling overheads.

In this guide, Scalex Technology explains how VAT on business energy works, who qualifies for reduced rates, and how to check your bill for accuracy.

What Is the VAT Rate on Business Energy?

The standard VAT rate for most UK businesses is:

🔹 20% on both electricity and gas

This is automatically added to your bill by your energy supplier.

However, some businesses qualify for a reduced VAT rate of 5%, depending on their size, usage, or type of operations.

Who Qualifies for the 5% Reduced VAT Rate?

✅ Low Energy Usage (De Minimis Threshold)

If your business uses less than the following each day, you’re eligible for 5% VAT:

- Electricity: 33 kWh or less per day

- Gas: 145 kWh or less per day (equivalent to 5 therms)

This is typically suited to small businesses, shops, or home-based offices.

📌 Tip: Check your annual usage—if it’s under 12,045 kWh of electricity or 52,925 kWh of gas, you may qualify.

✅ Charities & Non-Profits

Registered charities and not-for-profit organisations often qualify for the reduced 5% rate on all or part of their energy use—provided it’s used for non-commercial purposes, such as:

- Community centres

- Religious buildings

- Care homes

- Educational facilities

📄 You’ll need to submit a VAT declaration certificate to your supplier.

✅ Mixed-Use Premises (Partial VAT Relief)

If your site is used for both business and domestic purposes (e.g. a flat above a shop), you might only pay 5% VAT on the domestic portion.

In these cases, the supplier will pro-rata your usage and apply VAT accordingly.

How to Claim the Reduced VAT Rate

- Check your usage: Review recent bills or ask Scalex Technology for a usage report.

- Fill in a VAT declaration form: Most suppliers offer this on their website.

- Submit the form to your supplier: They’ll apply the reduced rate going forward and refund any overpayments (typically backdated up to 4 years).

- Keep a record: For audits or HMRC checks.

VAT on Other Energy Bill Charges

In addition to your unit rates and standing charges, VAT is also added to:

- Climate Change Levy (CCL)

- Third-party costs

- Network and distribution charges

This is why VAT may look higher than expected—especially if you’re on a flexible or pass-through contract.

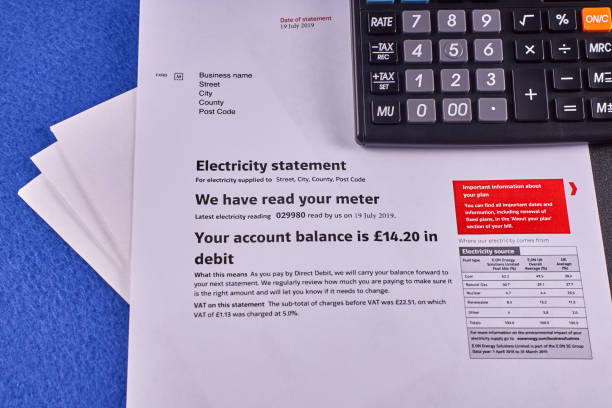

How to Check for VAT Errors

Here are a few common mistakes we find on business energy bills:

- Being charged 20% VAT despite qualifying for 5%

- Not applying VAT relief across all meters/sites

- VAT charged incorrectly on CCL-exempt usage

- Poor record-keeping or expired declarations

🔍 Let Scalex Technology perform a bill validation check—we often uncover VAT overcharges and help secure refunds.

How Scalex Technology Can Help

We help UK businesses by:

- Auditing energy bills for VAT compliance

- Submitting VAT declaration forms on your behalf

- Ensuring VAT and Climate Change Levy (CCL) are correctly applied

- Identifying other cost-saving opportunities in your energy contract

Final Thoughts: Don’t Overpay on VAT

VAT may seem like a small line on your bill—but over time, the savings (or errors) can be significant.

If you’re a small business, charity, or organisation with low energy usage, it’s well worth checking if you qualify for the reduced 5% VAT rate.

💡 Let’s Reduce Your Business Energy Costs

Contact Scalex Technology today for a free VAT eligibility check or full energy bill audit.

Don’t let energy taxes eat into your bottom line.